Blogs

- “Do I really must rebalance my personal money collection?”

- Ben Felix Model Profile (Mental Indication, PWL) ETFs & Remark

- VIG vs. VYM – Vanguard’s 2 Popular Bonus ETFs (Review)

- Am i going to really be not familiar when to try out gambling games on the the brand new a great BTC gambling enterprise?

- RTP (Return to Athlete)

- Ready to play Couch potato the real deal?

Thus, you’ll find nothing incorrect that have having fun with an almost all-in-you to ETF within the an RRSP and you can sometimes promoting products in order making your regular distributions. But not, Cathy and you may Brian, it’s really worth posting comments on the variety of VGRO. When you’re resigned and you may attracting off their RRSP to own money, a profile from 80% carries can be much too competitive.

“Do I really must rebalance my personal money collection?”

The eye away from a potato is the common name supplied to the tiny sprout otherwise bud region you to sticks out a tiny regarding the potato. This may eventually become a good potato plant (in the event the placed in the ground) and a lot more carrots can be grow from it. — We used to be a passive, but I discovered the new pleasure away from outside issues. — My wife has been a passive as the the girl mommy passed out and i believe she may require help to own depression. — From the time my cousin had an alternative console she’s got turned an entire passive. — The reason she never ever invites you over to their house is as the the woman mother are an excellent inactive and you may she actually is very embarrassed about any of it.

Ben Felix Model Profile (Mental Indication, PWL) ETFs & Remark

The phrase “inactive” was initially coined in the 1970s by Tom Iacino, a pal away from La broadcast servers Bob Denver. It gathered prevalent explore just after it had been searched inside an article in the La Minutes in the 1985. Microgaming is the developer of this online game also it’s the newest oldest vendor as much as. Their functions is subscribed from the both the Uk Gambling Fee and you may Malta Gambling Expert. We are able to getting their disappointment after discovering the fact truth be told there are not any totally free spins on the games. But Microgaming is not one particular slot company to depart your holding.

Fast forward to 2018, and then he says full stock exchange fund and overall bond business money. Scott Injury, a personal finance blogger, created the Passive Paying Approach inside 1991 rather for many who have been investing money executives in order to manage the investment. Couch-potato profiles are zero-maintenance and you can cheap and so they need minimal time for you to set up. A few of the Canadian robo-advisers have fun with inactive list ETFs because of their profiles. Other robos often implement particular positively managed ETFs, along with specific productive investment allocation.

VIG vs. VYM – Vanguard’s 2 Popular Bonus ETFs (Review)

The new exemption I’ll build we have found to own extremely over weight and you may obese members; the additional lbs you’re also carrying you could end up burns when you start the fresh running periods. It’s preferred for all of us to place of undertaking a training system as they convince by themselves it aren’t individually ready. This is actually the market for the Chair to help you 5K program, that’s designed for natural newbies. It’s now examine this link right now considered that more 10 million runners purchased it, and you can see multiple types of one’s new 9-week bundle online, possibly on the apps otherwise other sites. It really works really well, concise you to definitely actually Uk’s Federal Health Provider (NHS) has had mention making it a formal take action bundle. That’s as to why the fresh limited band of directory money from Orange and you may the fresh TD elizabeth-Collection try a true blessing inside the disguise because’s hard to damage.

Am i going to really be not familiar when to try out gambling games on the the brand new a great BTC gambling enterprise?

Each year, the guy said, you should rebalance the brand new profile which’s once more fifty% carries and fifty% securities. When it comes to using idioms, it’s important to learn the definition and you may perspective. That it terms is often always establish someone who uses an excellent great deal of time standing on your butt viewing television or performing absolutely nothing active. But not, there are several common errors that folks make when using that it idiom. The phrase “inactive” try a popular idiom in the English code you to means a person who uses a majority of their go out looking at a chair, watching television otherwise performing absolutely nothing active.

RTP (Return to Athlete)

- However, I’ll bet a large number of traders imagine their bond ETFs are trying to do worse than simply they are really.

- Learning tips rationally reach finally your wants has setting reasonable criterion for what success might look including, the guy authored.

- Yet , of a lot financial advisors are contemptuous of your entire idea.

- Nevertheless just heard someone say “That is a good trader’s field! Buy and you will hold try lifeless!” Uncover what they’ve been selling.

Truly, Couch potato are a delightful game one appeals to fans from antique harbors. Despite the minimal paylines, Inactive also offers independence according to coin use. That have one money, the original column lighting up; with a few coins, next line illuminates; with three gold coins, the 3rd line stands out. Needless to say, the next line has the highest payouts, correlating to the improved playing matter. Passive try a great around three-reel slot having one payline, proving the simple game play.

Here’s the fresh close-label research away from well-balanced collection habits, key as opposed to advanced. The first time We heard this notion, it actually was from the a good investment meeting back in the brand new mid-eighties and you can Jack Bogle, the fresh founder away from Cutting edge Assets, try speaking. He discussed their educational lookup one to turned out one to absolutely no one can continuously overcome the market industry over-long expands (including the 40 years we should instead purchase to have senior years).

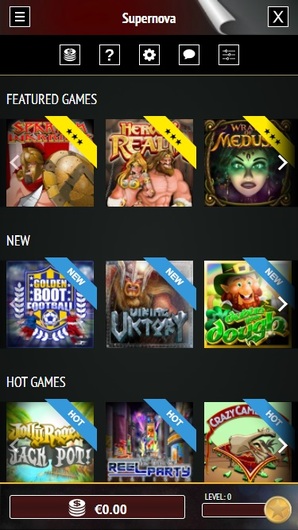

Ready to play Couch potato the real deal?

He’s yawning, base knocked right up, a secluded at your fingertips, and you can marks their lead. Rates of interest, inflation—let alone tariffs otherwise an economic downturn—makes money stressful. You start with a $100,100000 investment and withdrawing a first $cuatro,100000 a-year which is adjusted upward to own rising cost of living every year, that it table shows the brand new dollars value of the fresh collection during the prevent of every season. I’yards begin to question in the event the broad diversity is significantly quicker beneficial versus economic professionals let us know. In any event, for individuals who measure achievements from the maybe not running out of currency, Couch potato paying is looking pretty good.

You must hit at the least step three of the same cues to your the new reels to amount your earnings. When you meet this type of conditions, the newest prize is computed utilizing the multiplier of your productive symbol. The new wild substitutes someone else to create a winning integration that have a great 5x multiplier. Simultaneously, be aware of cultural variations in just how that it idiom is generally interpreted. Not everybody may be accustomed that expression, so it’s crucial that you put it to use rightly and you may explain the meaning if necessary. It’s also essential to quit stereotyping otherwise judging other people based on the habits.

For the high end of the all the-in-one to portfolio risk range is actually one hundred% collateral portfolios. These all-in-you to definitely possibilities needed because of the Canadian Passive are typical portfolios that has other ETFs within it. Just with a definite understanding of you to definitely’s monetary photo do they really then personalize the opportunities to satisfy their specific requirements. Whether or not your make an effort to pick a home, financing your son or daughter’s training, retire easily, otherwise achieve any monetary milestone, your own investment might be lined up appropriately. Before delving for the some of the collection options, an investor must learn their latest economic situation.